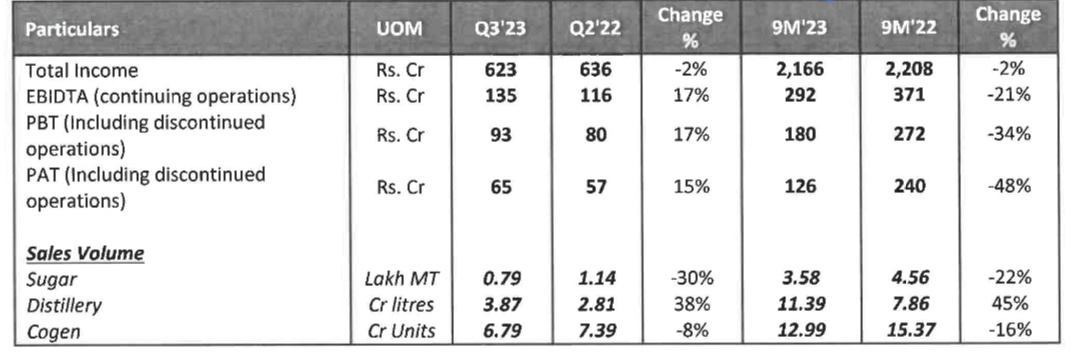

Dalmia Bharat Sugar and Industries Limited today announced its unaudited financial results for the quarter/nine months ended 31 Dec, 2022. Salient features are as under:-

After subdued first half, this quarter is much better on the back of higher value accretion from ethanol. However, EBIDTA for nine months was impacted mainly on account of reduction in margins due to higher carrying value of inventory (due to cane price increase in last season) not fully compensated by increase in sugar prices, lower sugar sales volumes, impact of increase in employee cost due to retrospective wage rate revision and increase in levy molasses obligation in Uttar Pradesh.

Operational Highlights: –

> Highest ever distillery sales at 11.39 Cr Litres in 9M’23 and 7.86 Cr litres in 9M’22.

> Highest ever distillery sales at 3.87 Cr litres in Q3’23 against 2.81 Cr litres in Q3’22.

> Crushed 19.56 LMT during the current season till Dec’22 as against 17.40 LMT during

last season till Dec’21.

> UP Normative sugar recovery during the current season till Dec 22 higher by around 0.30%

vis a vis last season till Dec’21.

Debt profile: –

Long term loan as on 31″ Dec, 2022 stood at Rs. 419 Cr, which is entirely under interest subvention scheme/subsidized loan with a long-term debt to equity ratio of 0.16x.

Project status: –

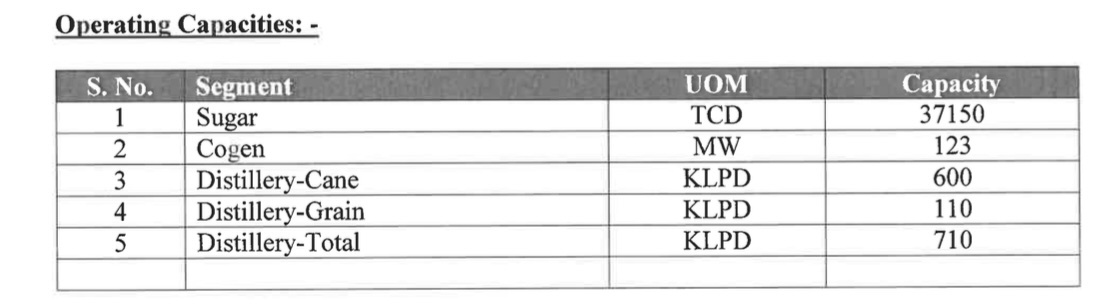

Jawaharpur grain distillery of 110 KLPD has been successfully commissioned during the quarter. With this total distillery capacity of the company has increased to 710 KLPD.

Ninaidevi sugar – capacity increased to 4000 TCD from 3000 TCD.

Ramgarh Sugar- Marginal capacity expansion & steam saving project completed. (Steam consumption reduced by around 10%)

Dividend: –

> The board has approved interim dividend of 150% @ Rs. 3/- per share (face value 2/-per share) for FY 23.

Ethanol Blending Programme updates: –

> OMCs have floated tender for EY 2022-23 (Dec’22-Oct’23) for a quantity of 600 Cr Ltrs, which is significantly higher than last ethanol year. This is a major step towards achieving 20% blending on Pan India basis from 2025-26 season.

> 475 cr litres finalized by OMCs so far against requirement of 550 Cr litres for 12% blending.

> Gol has mandated roll out of E20 material compliant vehicles from 1st April 2023 which will give significant boost to the EBP program.

Outlook for the sugar industry

Sugar production estimates for SS 22-23 are revised downwards to 340 LMT (net of diversion of 45 LMT) vis-a-vis 365 LMT (earlier estimates) mainly due to lower yields in Maharashtra and Karnataka. Closing stock for SS’23 is likely to be at 56 LMT i.e. at similar levels that of SS’22 with a reduced export estimate of 61 LMT.

The company expects domestic sugar prices to remain stable with positive bias due to optimum inventory levels.