Noida, January 24, 2023: Triveni Engineering & Industries Ltd. (‘Triveni’), one of the largest integrated sugar producers in the country, a dominant player in engineered-to-order high speed gears & gearboxes and a leading player in water and wastewater management business, today announced its financial results for the third quarter and nine months ended Dec 31, 2022 (Q3/9M FY 23). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

• All the businesses recorded growth in turnover during the quarter and 9M FY 23.

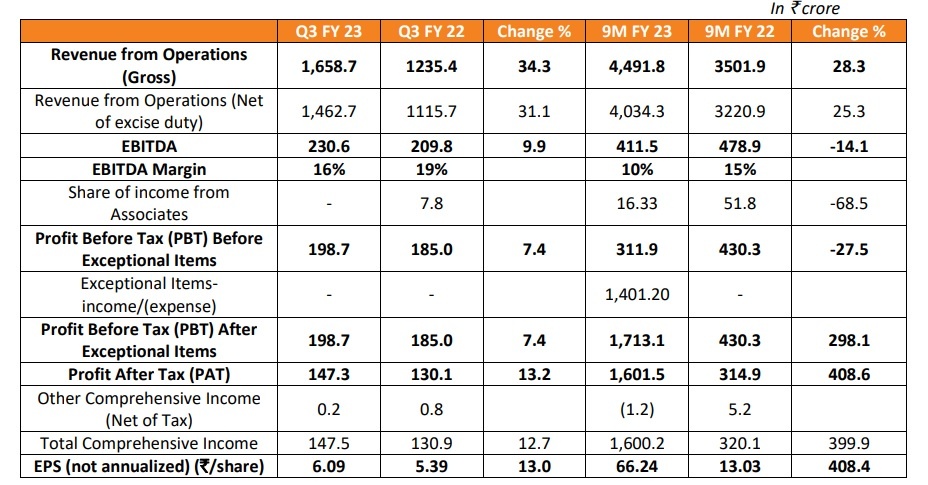

• Profit before tax (PBT) before exceptional items during Q3 FY 23 increased by 7.4% and declined by 27.5% in 9M FY 23 as compared to corresponding periods of previous year, to ₹ 198.7 crore and ₹311.9 crore respectively.

• The profitability in sugar business is lower as the cost of sugar sold pertaining to the previous season includes the impact of sugarcane price increase for the Sugar Season (SS) 2021-22 (and higher cost of sugar produced in the current season due to transitory lower recoveries). Further, 9M FY 22 included export subsidy of ₹ 57 crore relating to the previous period.

• Higher profitability of the aggregate Engineering businesses is owing to strong revenue increase of 45.8% and 35.8% during the current quarter and nine-month period under review over the corresponding periods last year.

• The total debt on a standalone basis as on December 31, 2022 is ₹ 389.09 crore as compared to ₹ 525 crore as on December 31, 2021. Standalone debt at the end of the quarter under review, comprises term loans of ₹ 334.39 crore, almost all such loans are with interest subvention or at subsidized interest rate. On a consolidated basis, the total debt is at ₹ 480 crore as compared to ₹ 592 crore as on December 31, 2021.

• Overall average cost of funds is at 4.75% during Q3 FY 23 as against 4.15% in the corresponding period of previous year.

• The Company holds surplus funds through short term fixed deposits of ₹ 1278 crore.

• Our proposed buyback of ₹ 800 crore is pending statutory approval.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said:

“Overall performance of the Company during the nine months ended December 31, 2022 has been satisfactory. In the current ongoing season, there is a declining trend of recoveries across the state of UP, for the ratoon crop, due to a variety of factors – mainly shortfall in rains in the grand growth period and thereafter, due to late rains in the month of October. However, in view of conducive weather, it is expected that there would be a catch-up in the balance part of the season for the plant crop and the gap will narrow down. We had addressed the issues relating to de-bottlenecking and modernisation in three of our sugar units and consequently, the crush during the quarter has increased by 25% over last year. However, the profitability of sugar operations has been impacted as cost of sugar sold in the current period includes the impact of the sugarcane price increase in the previous season, and it has not been fully offset by the increased sugar realization. We believe that it is the most appropriate time for the Government to reconsider the increase in the Minimum Support Price (MSP) of sugar to offset the impact of increased cane price. We have been able to get a remunerative export price having a substantial premium over the domestic sugar price, as a result of the Government making a timely announcement for the first tranche of exports of 6 million tonnes.

In view of our increased distillation capacities, our production and sales volumes have increased substantially. However, the profit has not increased commensurately due to increased transfer price of B-heavy molasses, initial stabilization period of new distilleries and relatively lower margins on grain operations. There is an urgent need for the Government to rectify the pricing of ethanol produced from sugarcane juice and grain to improve the viability and enhance investments. It will help in faster setting

up of additional capacity and achieve the targets of ethanol blending.

The performance of engineering businesses is satisfactory with both turnover and profitability registering strong growth. In the Water business, we continue to selectively focus on projects with healthy returns, both in domestic and international markets. Water business has participated in many tenders and expects to received orders of substantial value. Orders in hand for Power Transmission are higher by 23% over corresponding previous quarter. In this segment, the Company’s high speed licence agreement with Lufkin Gears LLC expired in January 2023 and the business will now pursue the high- speed high-power segment independently with a focus on enhancing global market share in its

identified target markets. We believe with an increased global presence, solid business model and strategy along with foray in defence will drive the Power Transmission business in the coming years.

Our proposed buyback of ₹ 800 crore is presently under approvals. The sale of stake in Triveni Turbine Limited has infused substantial funds in the Company, which, even after the proposed buyback, will meet the expansion requirements of the businesses and reduce finance costs on working capital requirements.”