Noida, October 30, 2023: Triveni Engineering & Industries Ltd. (‘Triveni’), one of the largest integrated sugar producers in the country, a dominant player in engineered-to-order high speed gears & gearboxes and a leading player in water and wastewater management business announced its financial results for the second quarter and half year ended Sep 30, 2023 (Q2/H1 FY 24). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

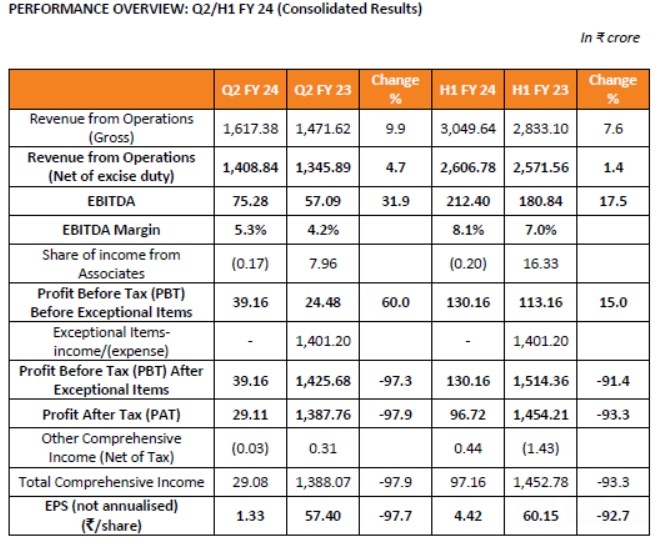

PERFORMANCE OVERVIEW: Q2/H1 FY 24 (Consolidated Results)

• Net turnover increased by 4.7% and 1.4% respectively in Q2 FY 24 and H1 FY 24 primarily driven by higher turnover in the Alcohol and Power transmission business.

o Sugar sales volumes (including exports) were lower by 5.9% and 10.6% in Q2 and H1 FY 24 respectively as compared to Q2 and H1 FY 23. However, the blended realization prices were higher by ~6% both in the quarter and half year. Consequently, the turnover was flat during the quarter and lower by 7.6% in the half year. Sales volumes for the current half-year include exports of 14,531 tonnes of sugar at remunerative prices, while there were no exports in the previous corresponding period.

o Alcohol business turnover (net of excise duty) increased by 19.8% and 20.5% in Q2 and H1 FY 24 respectively, over the corresponding period last year, due to higher sales volumes driven by operational efficiencies achieved post-initial stabilization period of newer distillery and increased activities in Indian Made Indian Liquor (IMIL).

o Combined engineering turnover increased by 8.7% and 15.3% for the quarter and half year over corresponding periods last year. This performance was boosted by a 28.4% and 44.8% increase in Power Transmission business revenues in Q2 FY 24 and H1 FY 24 respectively.

• Profit before tax and exceptional items (PBT) increased by 60% and 15% in Q2 FY 24 and H1 FY 24 to reach ₹130.16 crore at the half year milestone.

• The gross debt on a standalone basis as on September 30, 2023 is ₹ 295.66 crore as compared to ₹ 824.96 crore as on March 31, 2023. However, considering operational surplus funds held as fixed deposit (FD) of ₹ 285.50 crore, the net debt as on September 30, 2023 is at ₹ 10.16 crore. Standalone debt at the end of the quarter under review, comprises term loans of ₹ 281.94 crore, almost all such loans are with interest subvention or at subsidized interest rate. On a consolidated basis, the net debt after considering operational surplus funds held is at ₹ 100.90 crore as on September 30, 2023 as compared to ₹ 913.83 crore as on March 31, 2023. Overall average cost of funds is at 5.81% during Q2 FY 24 as against 5.16% in the previous corresponding period.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said:

“Overall performance of the Company during the half year ended September 30, 2023 has been satisfactory, given the fact that H1 is generally muted as the off-season expenses are expensed off. Our Alcohol business has grown well owing to the capacity expansions during FY 23 and stabilization of operations since then. Power Transmission business is charting new highs contributing in both size and growth to the Company as a whole.

We are all set for the new sugar season and on an overall basis, the crop seems healthier due to favourable climatic factors as well as due to rigorous sugarcane development activities undertaken by us. Sugar production for Sugar Season (SS) 2023-24 for the country is estimated to be lower as compared to 32.8 million tonnes in the recently concluded SS 2022-23 mainly on account of lower production in Maharashtra and Karnataka. However, the estimated production is still expected above the domestic consumption and we hope that the Government allows exports at an appropriate time to capitalize on high international sugar prices. Further, we would be closely reviewing the sugarcane price increase, if any, for the new season and hope that the Government allows increase in sugar prices to offset the impact of increase in sugarcane price. We have commenced sugarcane crushing at four sugar units for Sugar Season (SS) 2023-24.

Our focus in the Sugar business has been on maximising area under sugarcane and producing a healthy crop with enhancements in yield and recovery. The Company implements a robust sugarcane development programme with the farmer community through a multi-pronged strategy. This coupled with continued investments towards debottlenecking, enhancing the crush rate, higher production of refined sugar at our various units along with robust pricing environment are expected to contribute positively towards revenues and profitability. In the Alcohol business, we have been a strong supporter of the Government’s Ethanol Blended Petrol (EBP) programme and have actively bolstered our capacities while keeping pace with the expanding range of feedstocks for bio-ethanol production. We successfully raised our distillation capacity from 320 KLPD in FY 22 to an impressive 660 KLPD presently. Looking ahead, we are ambitiously working to

further expand our capacity to reach to 1110 KLPD.

During Q2 FY 24, the Company faced several feedstock challenges that led to disruption in planned production, such as abrupt stoppage of Surplus Rice by Food Corporation of India (FCI), introduction of Maize as feedstock, price volatility in feedstocks. It was creditable on the part of the Government to act swiftly to revise the prices of ethanol produced from Maize and from Damaged Food Grains (DFG). We are pleased to have a wide range of feedstocks to choose from and these will also mitigate the risks of dependency on a particular feedstock but it is equally important for the Government to set viable prices for each feedstock so that further capacity additions take place unabated to meet the overall ethanol blending targets.

In our Engineering businesses, we are enthused by the performance of the Power Transmission business in particular which continues to forge a growth path through enhanced addressable markets, diversification of product solutions and deepening its service portfolio and client relationships across the globe. In the Water business, despite the operational delays in certain projects, our outlook for the business remains positive as we believe that the demand for reliable water and wastewater treatment solutions will increase in the long-term, both in India and in International markets, leading to a healthy

flow of business.

At Triveni, our business strategy revolves around identifying and harnessing growth opportunities to achieve sustainable long-term value creation for our stakeholders. We continue to seize significant leadership opportunities in a rapidly evolving and competitive environment. The Company is well-equipped for the future to embrace the next phase of growth.”