Noida, July 25, 2023: Triveni Engineering & Industries Ltd. (‘Triveni’), one of the largest integrated sugar producers in the country, a dominant player in engineered-to-order high speed gears & gearboxes and a leading player in water and wastewater management business, announced its financial results for the first quarter ended Jun 30, 2023 (Q1 FY 24). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

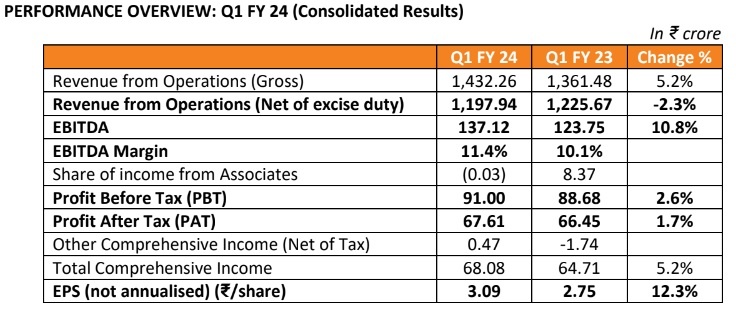

PERFORMANCE OVERVIEW: Q1 FY 24 (Consolidated Results)

Net turnover has declined by 2.3% in Q1 FY 24 primarily driven by lower turnover in the sugar business while the alcohol and aggregate engineering turnover improved over the previous corresponding period. Sugar turnover declined 15.2% over the corresponding period last year after considering exports, driven by a 21.7% decline in domestic sales volumes due to lower domestic quota allocations. Sales volumes for the current quarter includes exports of 14,531 tonnes of sugar at remunerative prices, while there were no exports in previous corresponding period.

Alcohol business turnover (net of excise duty) increased by 21.4% due to higher sales volumes driven by higher distillation capacities and increased activities in Indian Made Indian Liquor (IMIL).

Combined engineering turnover increased by 24.2% boosted by a 77.8% increase in Power Transmission business.

Profit before tax (PBT) increased by 2.6% in Q1 FY 24 to ₹ 91 crore.

The total debt on a standalone basis as on June 30, 2023 is ₹ 918.54 crore as compared to ₹ 824.96 crore as on March 31, 2023 and ₹ 1541.53 crore as on June 30, 2022. Standalone debt at the end of the quarter under review, comprises term loans of ₹ 281.16 crore, almost all such loans are with interest subvention or at subsidized interest rate. On a consolidated basis, the total debt is at ₹ 1011.07 crore as compared to ₹ 913.83 crore as on March 31, 2023 and ₹ 1617.68 crore as on June 30, 2022. Overall average cost of funds is at 6.71% during Q1 FY 24 as against 5.04% in the previous corresponding period.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said: “Overall performance of the Company during the quarter ended June 30, 2023 has been satisfactory. Alcohol and Engineering businesses contributed to 60% of the total segment results. There had been general trends of low recovery in the just concluded Sugar Season 2022-23 but the Company has outperformed the state of Uttar Pradesh in the same, with a decline of 23 bps in recoveries (on C-heavy molasses basis).”

He said, “In the Sugar business, we continue to focus on yield improvement initiatives by making our farmers adopt the best agricultural practices, through continual engagement with them and showing them the results in the demonstration plots which have been set up in each key area. It will be accompanied with increasing crush capacities progressively in sync with increased sugarcane availability. The Company is also in the process of increasing its refined sugar production to ~70% (up from ~60% currently) by changing the manufacturing process at its sugar unit in Milak Narayanpur. Activities previously announced pertaining to modernisation, debottlenecking and efficiency improvements are progressing well. The condition of the sugarcane crop and the rainfall so far has been satisfactory in the catchment areas of our sugar mills but the continuance of good climatic conditions in the subsequent period are critical for the performance in the forthcoming season. We are also embarking on digitization of sugarcane activities to increase productivity and our response time to the issues requiring immediate action.”

“In the Alcohol business, we have been a strong supporter of the Government’s Ethanol Blended Petrol (EBP) programme and have actively bolstered our capacities while keeping pace with the expanding range of feedstocks for bio-ethanol production. We successfully raised our distillation capacity from 320 KLPD in FY 22 to an impressive 660 KLPD presently. Looking ahead, we are ambitiously planning to further expand our capacity to 1110 KLPD,” Sawhney further added.

MD stated that our Engineering businesses continue to perform well with healthy order books and enquiry pipelines. In the Power Transmission business, the demand for high-speed gear solutions is witnessing a significant upswing in recent times in industries across various sectors, such as, steel, oil & gas, petrochemicals, etc. as these are seeking advanced and efficient power transmission solutions to optimise their operations. In the Water business, the demand for reliable water and wastewater treatment solutions is on the rise both in India and in International markets. Apart from participating in domestic projects, we are aiming to expand our global footprint, establish strategic partnerships, and foster mutually beneficial relationships with key stakeholders.

“At Triveni, we have strategically positioned ourselves to capitalise on emerging opportunities in both domestic and international markets in our various businesses. And as we forge ahead, our unwavering dedication to delivering exceptional value to our stakeholders remains at the core of our business strategy”, he concluded.